Weekly News Update // Week of March 22, 2021

By TRAUB On March 26, 2021

Here's TRAUB's roundup of recent consumer and retail news. Anthropologie unveils first digital-only catalog on Pinterest, former GAP CEO launches $200M SPAC to buy fashion brands, Chobani reaches distribution deal with PepsiCo for some products, and more.

M&A and INVESTMENTS

- L’Oréal Takes Minority Stake in Environmental Tech Start-Up Gjosa BoF

- GoPuff raises $1.15B as its valuation doubles Retail Dive

- DTC furniture startup Tylko raises $26M Retail Dive

- Fanatics hits $12.8B valuation after latest funding round Retail Dive

- Eat Just gets $200M investment Food Dive

- Cultured meat startup Meatable raises $47M to fund growth Food Dive

INDUSTRY NEWS

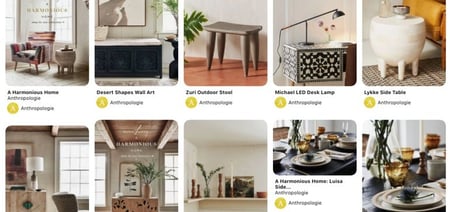

Anthropologie unveils first digital-only catalog on Pinterest

Anthropologie aims to convert Pinterest users into shoppers with its first digital-only catalog on the photo-sharing platform. Although consumers are growing more comfortable with the idea of returning to brick-and-mortar stores and shopping malls as the economy reopens from the pandemic, online shopping likely will remain popular among consumers who are looking ways to save time or are concerned about safety. Anthropologie's digital-only catalog has some advantages over print versions in letting people collect images on Pinterest's digital pinboards, creating a "look book" of design ideas before making a direct purchase. "No matter how much shopping has changed, inspiration will always play a critical role in helping consumers decide what to buy for their homes, which is why we chose Pinterest for Anthropologie's new digital-only catalog," Barbra Sainsurin, executive director of e-commerce, said in a statement. Retail Dive

Former Gap CEO Art Peck Launches $200 Million SPAC to Buy Fashion Brands

Paperwork was filed earlier this week by Peck with the Securities and Exchange Commission to raise money for a special purpose acquisition company (SPAC). Peck’s SPAC, Good Commerce Acquisition Company, plans to buy companies that sell apparel, accessories, and home goods, amongst other products.” Our objective is to create a next-generation consumer holding company by combining exceptional brands and leadership teams in the apparel & accessories, outdoor, health and wellness, home and other consumer-related industries to create long-term value for our shareholders,” Peck wrote in the filing, which was first reported on by Seeking Alpha. SPACs have become a hot Wall Street trend. These companies are founded to gather funds in order to buy or merge with other companies. Peck, who had a long career at Gap before serving as chief executive from 2015 through 2019, will serve as chief executive of the new venture. Peck has also brought on Abinta Malik, another former Gap executive, as President. Malik worked at the retail giant for over 20 years, most recently as an executive vice president. BoF

Carlyle Takes Majority Stake in End. as Streetwear Deals Heat Up

Streetwear’s run of pandemic-era M&A deals shows no sign of slowing down. End., the menswear retailer known for its curated mix of luxury streetwear and sports apparel, has nabbed itself a new partner: The Carlyle Group — the investment firm that helped Supreme scale into a streetwear juggernaut worth $2.1 billion. End., the menswear retailer known for its curated mix of luxury streetwear and sports apparel, has nabbed itself a new partner: The Carlyle Group — the global investment firm that recently sold Supreme to VF Corp at a $2.1 billion valuation. The companies said Tuesday that Carlyle is set to acquire a majority stake in the Newcastle-based company for an undisclosed sum. The deal values End. at £750 million ($1 billion), according to a Bloomberg report. Carlyle declined to comment on the figure. Co-founders Christiaan Ashworth and John Parker will retain a significant minority stake and remain co-CEOs. Investor Index Ventures, which bought a minority stake in the retailer for an undisclosed sum in 2014, will cash out. The acquisition is the latest in a string of pandemic-era deals in the streetwear space. In November, Supreme was bought by VF Corp, one of the largest apparel groups in the world. Then outerwear behemoth Moncler purchased Stone Island in a €1.2 billion ($1.4 billion) deal in December. BoF

Wellness brand Care/of to drop new vitamin line at Target

As Care/of's latest product launch appears on the shelves, the saga of Target's DTC partnerships continues. This time, Target is trying to give people a reason to stop by its vitamin aisle. Care/of's vitamin line at Target was produced based on findings from the six million people who have taken the brand's quiz in the past four years, the company said. "All products are Certified C.L.E.A.N., non-GMO, sugar-free, gluten-free, vegan or vegetarian, and contain no unnecessary fillers," the release said. Partnerships between DTC brands and big-box retailers have grown increasingly popular in recent years. And Target, with its identity as a one-stop-shop destination, has served as a popular middleman for DTC brands that want to expand their reach to a new group of consumers, including those that opt to shop in physical locations. Retail Dive

Kanye West and Gap Have Billion-Dollar Ambitions for Yeezy Deal

Kanye West’s deal-making with two of the world’s largest outfitters is paying off for the musician-turned-entrepreneur after he spent years mired in debt.Yeezy, West’s sneaker and apparel business with Adidas AG and Gap Inc., is valued at $3.2 billion to $4.7 billion by UBS Group AG, according to a private document reviewed by Bloomberg. The value of the new Gap tie-up, which will hit stores this summer, could be worth as much as $970 million of that total, the bank estimated.The bank document reveals the ambitions of an alliance that hopes to emulate the success of the Adidas partnership. West, who retains sole ownership and creative control of the Yeezy brand, signed a 10-year agreement last year to design and sell clothes for men, women and kids under the Yeezy Gap label. (The arrangement excludes footwear; Yeezy’s partnership with Adidas is in place until 2026.) BoF

Afterpay shopping event to include physical retail for the first time

Afterpay's brick-and-mortar push follows the payment platform's expansion into retail stores in October. The company said it first introduced the in-store feature in Australia and New Zealand five years ago before piloting it in select U.S. stores. With the app, customers can pay in installments through their mobile wallets. The startup noted that its platform drove 45 million shoppers to retailers via the Afterpay Shop Directory in December alone. The company said it also added a "favorites" feature this year, allowing shoppers to save their desired items for later. "We have extended our sale to physical retail, doubled the number of sale days and, most importantly, we have more than doubled the amount of merchants who are offering incredible deals and promotions to their shoppers," Melissa Davis, Head of North America at Afterpay said, in a statement. "We are proud to deliver this incredibly popular event just as retailers welcome their customers back to their stores for Spring shopping." Retail Dive

Chobani reaches distribution deal with PepsiCo for some products ahead of possible IPO

When it comes to scaling up, finding ways to tap into existing supply chains instead of having to create ones from scratch offers an expedited approach. With Chobani gearing up for a possible IPO, boosting its market share, profits and consumer exposure are key priorities. As the pandemic continues to impact consumers' eating habits, many people are opting for healthier food and beverage options that have more natural, recognizable ingredients. Ensuring that its products targeting these areas are within easy reach and taste fresher will help Chobani capitalize on these shifting trends. Chobani has been investing heavily in launching new products in recent years. With the pandemic providing many consumers with an opportunity to think differently about their diets and how they shop, a new distribution deal with PepsiCo could be excellent timing. Chobani said it was attracted to PepsiCo's vast distribution network as a way to bring more of its better-for-you offerings to consumers. Food Dive

Gucci Is Selling $12 (Virtual) Sneakers

In collaboration with fashion-tech company Wanna, the Italian house is debuting a digital sneaker, available to purchase for $11.99 on its app or $8.99 on Wanna’s app. Designed by creative director Alessandro Michele, the sneaker is also the first original digital product from Belarus-based Wanna, which specialises in using augmented reality (AR) to create 3D models for digital fittings of sneakers and watches. So far, the app’s technology has been used by Reebok, Farfetch, Puma and Snapchat to test out how consumers engage with virtual try-ons, and perhaps more importantly, taking photos of themselves with new products using augmented reality. The brand previously worked with Wanna to digitalise its sneaker catalogue for AR try-ons as well as integrating the capabilities within the brand’s own Gucci app. The frenzy around digital-only products has grown in recent weeks, in part due to the large sales of digital assets in the form of non-fungible tokens (NFTs), the rise in online gaming and the continued pandemic e-commerce boom. Wanna co-founder and CEO Sergey Arkhangelskiy is confident in the digital fashion market and the company is looking to expand beyond shoes and watches to clothing. He also predicts AR technology like Wanna’s will be further integrated into brands and retailers’ online shops. “In five or maybe 10 years a relatively big chunk of fashion brands revenue will come from digital products,” he said. “Our goal as a company is to actually supersede the product photos ... and substitute it for something which is way more engaging and closer to offline shopping.” BoF

Hudson's Bay online marketplace will feature more than 500 third-party sellers

Hudson's Bay is preparing to enter into the crowded marketplace space. The retailer, a sister company to Saks Fifth Avenue and Saks Off 5th, said the marketplace initiative is part of its "digital-first strategic evolution," and is inviting large and small businesses to become a part of its seller community. Vendors must fill out an application to be considered for the program and answer questions about whether they ship to Canada, sell on other marketplaces or are BIPOC-owned or designed, and how many retailers currently carry their brand. Marketplaces have become an imperative line of revenue for many large retailers, which can collect commissions and fees from their sellers. Amazon this week revealed that its marketplace played a large role in its fourth quarter, with independent sellers landing 50% year-over-year sales growth. Retail Dive

Ted Baker Becomes First Fashion Brand With a ‘Club’ on Clubhouse

The British label is launching a branded-content series on the audio-only platform hosted by Abraxas Higgins, an active Clubhouse user with 370,000 followers on the app. Ted Baker has six talks scheduled with Higgins, where the hour-long conversations will discuss the intersection of British culture and fashion. Guests like artists Greta Bellamacina and Kojey Radical, both of whom appeared in Ted Baker’s most recent campaign, will participate in the discussions.”We see Clubhouse as an opportunity to experiment with new and innovative digital formats and develop our cultural capital,” said Jennifer Roebuck, Ted Baker chief customer officer, in a statement. Although Clubhouse, which is still invite-only, has been growing rapidly since it launched in beta last year, brands have not been officially allowed to join the platform — until now. “Clubs” are groups on the platform that users can follow, and Ted Baker’s “profile” on the platform will be in the form of a ‘club.’ Fashion and beauty brands, eager to get in on the action early, have been searching for the next crop of talent poised to be stars on Clubhouse while some founders themselves have actively participated in discussions. So far, the platform does not have advertising tools like those found on TikTok or Instagram. BoF

COMINGS & GOINGS

- Condé Nast names Jackie Marks chief financial officer BoF

- Alegra O’Hare appointed global chief marketing officer at Tommy Hilfiger BoF

- Osman Ahmed appointed fashion features director at i-D BoF

- Cai Xukun is the new face of De Beers BoF

GOOD READS

- Alternative proteins may capture 11% of total protein sales by 2035 Food Dive

.png?width=456&height=312&name=logo-vert-traub%20(2).png)